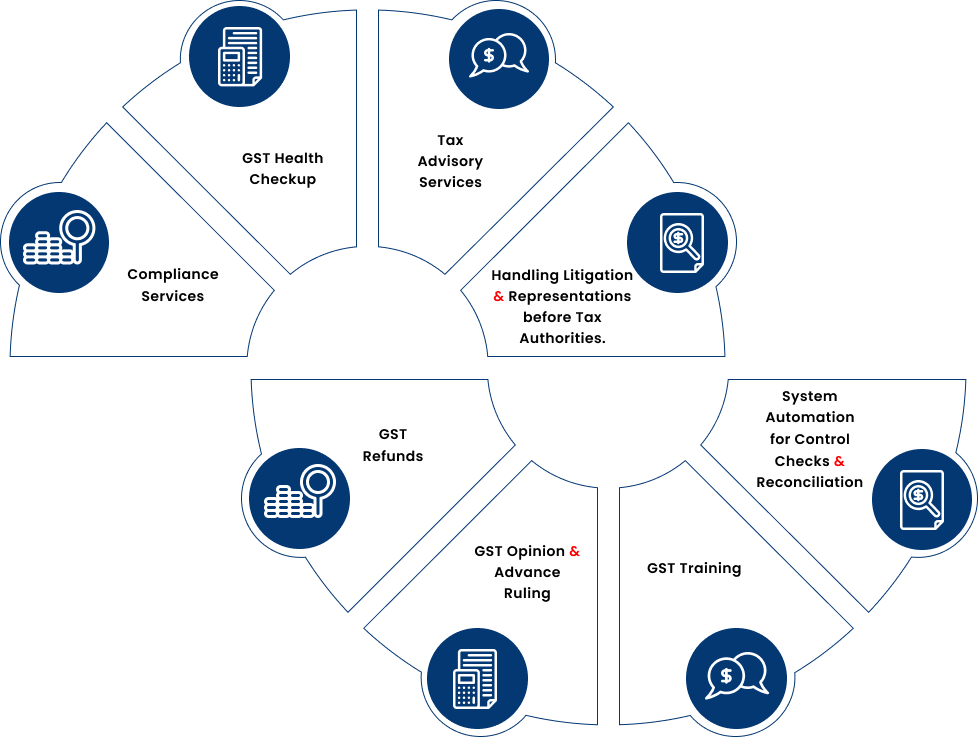

Indirect Tax GST

At Mistry & Shah LLP, we specialize in navigating the complexities of Goods and Services Tax (GST) regulations for businesses across all sectors. Our comprehensive GST services include expert assistance with GST registration, meticulous GST return filing and reconciliation, handling GST 9-9C annual returns, compliance reviews, and advisory on E-Way Bill and E-Invoice implementation etc. We offer GST Health Checkup Services to proactively identify compliance issues and optimize GST processes, ensuring businesses mitigate risks effectively. Our experienced GST professionals provide dedicated support for dispute resolution, offering litigation support and representation services to resolve issues with tax authorities efficiently. We also facilitate smooth GST refund processes, ensuring timely refunds for our clients. Stay ahead with our GST training services, equipping businesses and professionals with up-to-date knowledge to navigate the evolving GST landscape confidently. Our system automation solutions streamline control checks and reconciliation processes, enhancing compliance and operational efficiency.

Compliance Services

- GST Registration and Amendments

- Monthly/Quarterly GST Return Filing (GSTR-1, GSTR-3B, GSTR-9, etc.)

- Reconciliation of GSTR-2A/2B with Purchase Registers

- E-Invoicing Compliance and Integration Support

- E-Way Bill Generation and Management

- Advisory on GST Rate Classification and HSN/SAC Codes

GST Heath Checkup

- Review and reconciliation of GST returns with books of accounts

- Verification of Input Tax Credit (ITC) claims and 2A/2B matching

- Assessment of GST rate classification and RCM compliance

- Identification of risks, errors, and corrective actions

- Suggestions for Process Improvements and Documentation Gaps

- Preparation of Actionable Compliance Report

Tax Advisory Services

- Advisory on GST applicability and structuring of transactions

- Guidance on GST rate classification and HSN/SAC codes

- Input Tax Credit (ITC) optimization and compliance support

- GST advisory for mergers, demergers, and business restructuring

Handling Litigation & Representations before Tax Authorities

- GST Assessment Disputes

- GST Audit Representation

- Opting for Advance Ruling

- Preparation & Filing of Appeal

- Response to Notices

GST Refunds

- End-to-end assistance in GST refund filing

- Refunds for exports, SEZ supplies & inverted duty structure

- Preparation of required documentation and justifications

- Coordination with GST department for timely processing

- Advisory on refund eligibility and compliance

GST Opinion & Advance Ruling

- Expert opinions on complex GST issues and transaction structuring

- Drafting and filing of applications for Advance Rulings

- Representation before Authority for Advance Ruling (AAR) and Appellate Authority

- Legal support for dispute resolution and departmental queries

GST Training

- Customized training sessions for finance, accounts & compliance teams

- Updates on latest GST amendments, rules, and notifications

- Industry-specific GST training modules

- Workshops on GST audits, litigation, and best practices

System Automation for Control Checks & Reconcialiation

- Automated Control Checks

- Reconciliation Automation

- Compliance Monitoring & Reporting