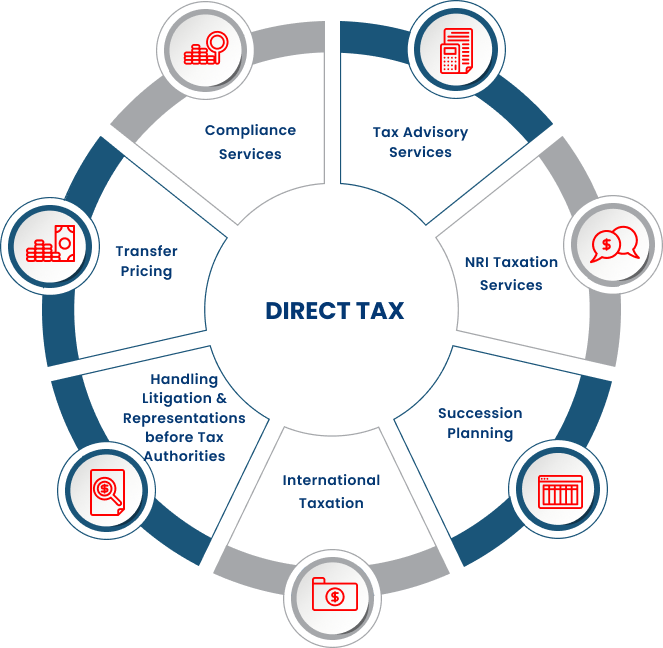

Direct Tax

At Mistry & Shah LLP, we specialize in ensuring Direct Tax compliance and optimizing tax strategies through our comprehensive direct tax services. We prioritize, timely and accurate filing of Tax Returns and Forms for a wide range of entities, including individuals, Partnership Firms, LLP, HUF, Trusts, Corporate etc. Our expert team conducts regular compliance reviews to identify potential issues and enhance tax planning effectiveness. Specializing in transfer pricing solutions, we assist multinational businesses in navigating cross-border complexities with confidence. We also provide robust support for income tax litigation, ensuring favorable outcomes through our specialized expertise. Understanding the nuances of international tax laws, we craft effective strategies for businesses and individuals engaged in global transactions. Moreover, our firm excels in succession planning, facilitating seamless wealth transition while minimizing tax implications. For Non-Resident Indians (NRIs), we offer tailored tax services to manage income tax obligations in India efficiently.

Compliance Services

- Preparation and Filing of ITR for individuals, firms, companies, and other entities

- TDS, TCS Compliance

- Form 15 CA CB Filing

- Computation and payment of Advance Tax

- Conducting Tax Audit

Tax Advisory Services

- Strategic Tax Planning

- Transaction Structuring

- Capital Gains Tax Advisory

- Advisory on Tax Incentives & Exemptions

- Tax Due Diligence for M&A and Investments

NRI Taxation Services

- Determination of Residential Status under Indian Tax Laws

- Tax Planning for Income Earned in India and Abroad

- Advisory on Double Tax Avoidance Agreement (DTAA) Benefits

- Capital Gains Tax Advisory on Sale of Property or Investments in India

- Repatriation of Funds – Tax and Regulatory Guidance

- Assistance with NRO to NRE Account Transfers

Succession Planning

- Estate and Inheritance Tax Planning

- Family Business Succession

- Wealth Transfer Strategies

- Tax Compliance and Reporting

International Taxation

- Cross-Border Tax Planning

- Transfer Pricing Advisory

- Foreign Tax Credit Planning

- Tax Treaty Interpretation and Application

Handling Litigation & Representations before Tax Authorities

- Income Tax Dispute Resolution

- Income Tax Appeals and Tribunals

- Income Tax Litigation Support

- Approaching Settlement Commission

- Opting for Advance Ruling

Transfer Pricing

- Planning & Strategy

- Documentation & Compliance

- Audits

- Advisory & Training