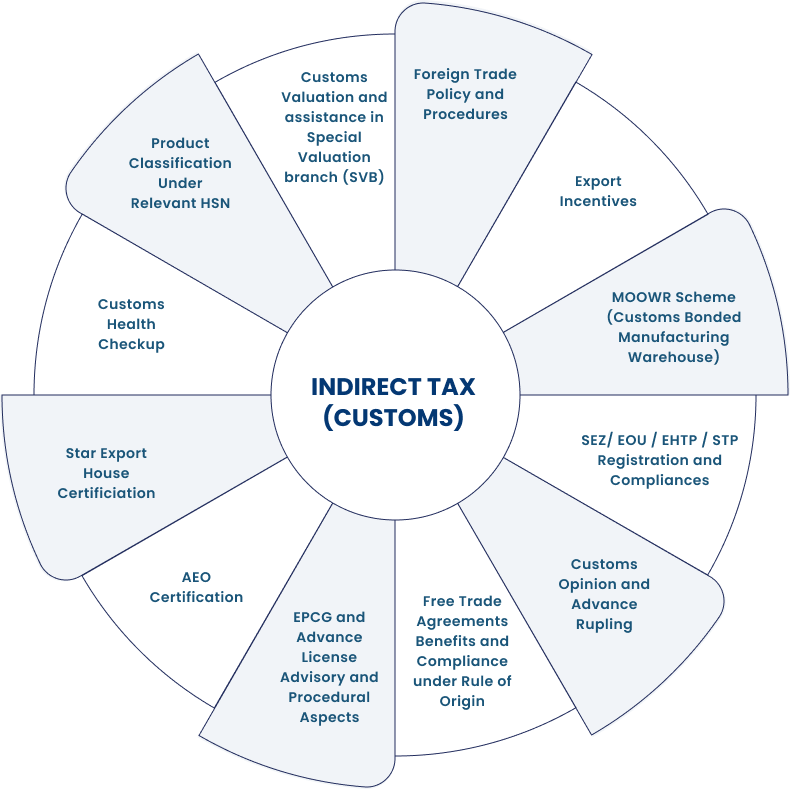

Indirect Tax (Customs)

We understand the challenges businesses face when dealing with customs regulations. That’s why we offer expert customs advisory services to help businesses navigate the complexities of customs compliance and optimize their international trade operations. Ensuring compliance with customs regulations is essential to avoid delays, penalties, and other risks associated with international trade. Our team of customs experts provides comprehensive customs compliance and risk management services, helping businesses identify and mitigate potential compliance issues and risks.

Foreign Trade Policy & Procedures

Navigating the complexities of foreign trade policy and procedures is essential for businesses looking to expand their international footprint and capitalize on global opportunities. We offer expert guidance and support to help businesses understand and comply with foreign trade regulations, optimize their international trade operations, and mitigate risks associated with cross-border transactions.

- Foreign Trade Policy Analysis

Understanding the intricacies of foreign trade policy is crucial for businesses engaged in international trade. Our team of experts provides comprehensive analysis of foreign trade policies, including tariff schedules, export-import regulations, trade agreements, and incentives. We’ll help you stay informed about changes in foreign trade policies and assess their impact on your business operations. - Export-Import Compliance Assistance

Ensuring compliance with export-import regulations is essential to avoid penalties and delays in international trade transactions. Our firm offers expert assistance in export-import compliance, helping businesses understand their obligations and navigate the complexities of customs regulations, documentation requirements, and trade sanctions. - Trade Facilitation and Optimization

Streamlining trade processes and optimizing supply chain efficiency are essential for businesses looking to compete in global markets. Our team provides strategic guidance and solutions to help businesses optimize their trade facilitation processes, reduce trade barriers, and enhance supply chain visibility and agility.

Export Incentives

MOOWR Scheme (Customs Bonded Manufacturing Warehouse)

We understand the significance of staying updated with the latest customs regulations and schemes. With the MOOWR Scheme, our team of experienced customs advisors is dedicated to assisting businesses in navigating the intricacies of this scheme to maximize benefits.Our services include:

- Scheme Eligibility Assessment:

We conduct a thorough assessment of your business operations to determine eligibility for the MOOWR Scheme. Our experts analyze various factors including product categories, Quantum of Export and Import, and compliance requirements to ensure that your business qualifies for the scheme and the same is beneficial to them. - Benefit Analysis between MOOWR and Various other Schemes:

Through our thorough understanding of MOOWR and Various other Schemes, we analyse that Entity should avail benefit under which scheme, that will provide them the maximum benefit. Further Our engagement doesn’t end with successful enrollment in the MOOWR Scheme. We continuously monitor changes in regulations and market dynamics to optimize benefits for our clients. Periodic reviews are conducted to assess the effectiveness of the strategy and make necessary adjustments to enhance benefits further. - Documentation and Compliance Support

Navigating customs documentation and compliance requirements can be daunting. Our team provides comprehensive support in preparing and filing the necessary documentation to ensure compliance with MOOWR Scheme regulations. From application submissions to periodic reporting, we handle the entire process efficiently.

SEZ/ EOU / EHTP / STP Registration & Compliances

We help you navigating the intricacies of Special Economic Zone (SEZ), Export Oriented Unit (EOU), Electronic Hardware Technology Park (EHTP), and Software Technology Park (STP) regulations and compliances. In today’s dynamic business landscape, operating within these specialized zones offers numerous advantages, including tax incentives, duty exemptions, and streamlined regulatory processes. However, ensuring compliance with the diverse requirements of these schemes demands expert guidance. That’s where we come in.

- Registration Assistance:

We guide businesses through the intricacies of the registration process for SEZs, EOUs, EHTPs, and STPs. From initial eligibility assessment to document preparation and submission, our experienced team ensures a smooth and hassle-free registration experience. - Compliance Management:

Compliance requirements within SEZs, EOUs, EHTPs, and STPs are multifaceted and constantly evolving. Our experts stay abreast of the latest regulatory developments to help clients maintain compliance with all applicable laws and regulations. We provide proactive guidance on tax, customs, and regulatory compliance to mitigate risks and optimize operational efficiency. - Customized Advisory Services:

Every business operating within SEZs, EOUs, EHTPs, or STPs has unique needs and objectives. Our advisory services are tailored to address the specific challenges and opportunities faced by each client. Whether it’s maximizing tax benefits, optimizing supply chain management, or navigating export-import procedures, we provide strategic guidance to support our clients’ success. - Review / Heath Checkup Assignments:

Our Review services help clients maintain transparency and accountability in their operations within SEZs, EOUs, EHTPs, and STPs. We conduct thorough review to ensure compliance with statutory requirements, internal policies, and best practices, providing valuable insights to drive continuous improvement.

Customs Opinion & Advance Rupling

we understand the importance of obtaining clarity on customs matters to mitigate risks, minimize disputes, and maximize benefits. Our range of Customs Opinions and Advance Rulings services includes:

- Customs Opinions:

Our experienced customs advisors provide expert opinions on various customs matters, including tariff classification, valuation, origin determination, and duty exemption eligibility. Whether you’re importing/exporting goods, seeking clarification on specific customs procedures, or exploring duty-saving opportunities, we offer timely and reliable opinions to support your decision-making process. - Advance Rulings:

Advance rulings provide businesses with official interpretations of customs laws and regulations before engaging in specific import/export transactions. Our team assists clients in preparing and submitting advance ruling requests to customs authorities, ensuring compliance with procedural requirements and maximizing the likelihood of obtaining favorable rulings. We liaise with customs officials on behalf of our clients to facilitate the advance ruling process efficiently and effectively. - Risk Assessment and Mitigation:

Uncertainty regarding customs duties and regulations can expose businesses to compliance risks and financial liabilities. Our customs experts conduct comprehensive risk assessments to identify potential areas of concern and develop strategies to mitigate risks proactively. By obtaining customs opinions and advance rulings, businesses can navigate international trade with confidence and certainty, minimizing the likelihood of customs-related issues and penalties.

Free Trade Agreements Benefits & Compliance under Rule of Origin

We specialize in providing comprehensive advisory services to help businesses capitalize on the benefits of Free Trade Agreements (FTAs) and ensure compliance with the intricate rules of origin. FTAs play a crucial role in facilitating international trade by reducing or eliminating tariffs and other trade barriers between participating countries. However, navigating the complex regulations and requirements associated with FTAs, particularly the rules of origin, can be challenging. That’s where we come in. Our range of services related to FTA benefits and compliance under the rule of origin includes:

- FTA Analysis and Assessment:

We conduct in-depth analyses of relevant FTAs to identify opportunities for duty savings and other trade benefits for our clients. Our experts assess the specific provisions of each FTA, including tariff schedules, rules of origin, and preferential treatment criteria, to determine eligibility and quantify potential benefits. - Rule of Origin Compliance:

Compliance with the rules of origin is essential for claiming preferential tariff treatment under FTAs. Our team provides expert guidance on navigating the complex rules of origin, including product-specific requirements, value-added criteria, and documentation obligations. We assist clients in understanding and fulfilling the necessary compliance requirements to ensure eligibility for FTA benefits. - Documentation and Recordkeeping Support:

Proper documentation and recordkeeping are critical aspects of FTA compliance. Our team offers comprehensive support in preparing and maintaining the necessary documentation, including certificates of origin, supplier declarations, and compliance records. We ensure that clients have the documentation required to substantiate claims for preferential tariff treatment under FTAs.

EPCG & Advance License Advisory & Procedural Aspects

We help navigating the complexities of Export Promotion Capital Goods (EPCG) and Advance License schemes. As businesses aim to expand their global footprint and capitalize on international trade opportunities, leveraging government incentives and schemes becomes essential. EPCG and Advance License schemes are instrumental in promoting exports by providing duty benefits and facilitating the import of capital goods and raw materials. Our advisory services are designed to help businesses maximize the benefits of these schemes while ensuring compliance with procedural requirements.a

- Scheme Eligibility Assessment:

We conduct thorough assessments to determine the eligibility of businesses for the EPCG and Advance License schemes. Our experts analyze various factors, including export potential, product categories, and compliance requirements, to assess eligibility criteria and identify opportunities for duty savings. - Application and Documentation Support:

Navigating the application and documentation requirements of EPCG and Advance License schemes can be daunting. Our team provides comprehensive support in preparing and filing the necessary applications and documentation to ensure compliance with procedural requirements. From initial application submissions to post-approval documentation, we handle the entire process efficiently. - Compliance Monitoring and Reporting:

Compliance with procedural requirements is essential for maintaining eligibility under EPCG and Advance License schemes. Our experts provide ongoing monitoring and reporting services to ensure that clients remain compliant with all applicable regulations and obligations. We conduct periodic reviews and audits to assess compliance status and identify any areas for improvement.

AEO Certification

We help in navigating the complexities of international trade and customs regulations. As businesses expand their global footprint and engage in cross-border transactions, ensuring efficient and secure supply chain management becomes paramount. Authorized Economic Operator (AEO) Certification is a globally recognized standard that signifies a company’s commitment to customs compliance, security, and reliability. Our AEO Certification services are designed to help businesses achieve and maintain AEO status, unlocking a range of benefits and facilitating smoother trade operations.

- AEO Eligibility Assessment:

We conduct a thorough assessment of your business operations to determine eligibility for AEO Certification. Our experts analyze various criteria, including customs compliance history, financial solvency, and security standards, to assess your readiness for AEO status. - AEO Application Preparation and Submission:

Navigating the AEO application process requires careful preparation and attention to detail. Our team provides comprehensive support in preparing and submitting the necessary documentation and information required for AEO Certification. We ensure that all requirements are met and that your application stands the best chance of approval. - Customized Security and Compliance Solutions:

AEO Certification involves meeting stringent security and compliance standards set by customs authorities. Our experts work closely with clients to develop customized security and compliance solutions tailored to their specific needs and objectives. We help businesses implement measures to enhance supply chain security, streamline customs procedures, and minimize compliance risks. - AEO Compliance Monitoring and Reporting:

Maintaining AEO Certification requires ongoing compliance monitoring and reporting. Our team provides comprehensive support in monitoring changes to customs regulations, conducting periodic reviews of compliance status, and preparing compliance reports for submission to customs authorities. We ensure that your AEO status is maintained, allowing you to continue enjoying the benefits of AEO Certification.

Star Export House Certificiation

we specialize in helping businesses achieve excellence in exports through Star Export House Certification. As businesses aim to expand their global reach and enhance their competitiveness in international markets, obtaining Star Export House Certification becomes instrumental. This prestigious certification is awarded by the Government of India to recognize outstanding export performance and contribution to the country’s export growth. Our Star Export House Certification services are designed to guide businesses through the certification process and unlock the benefits of this esteemed recognition.Our range of services includes:

- Certification Eligibility Assessment:

We conduct a thorough assessment of your export performance and business operations to determine eligibility for Star Export House Certification. Our experts analyze various criteria, including export turnover, growth trajectory, and compliance with export regulations, to assess your readiness for certification. - Application Preparation and Submission:

Navigating the Star Export House Certification application process requires meticulous preparation and attention to detail. Our team provides comprehensive support in preparing and submitting the necessary documentation and information required for certification. We ensure that all requirements are met and that your application stands the best chance of approval.

Customs Health Checkup

We offer specialized Customs Health Checkup services to help businesses assess their customs compliance, identify areas for improvement, and optimize efficiency in international trade operations. Navigating the complexities of customs regulations and procedures can be challenging, and non-compliance can result in costly penalties and disruptions to business operations. Our Customs Health Checkup services are designed to provide businesses with a comprehensive assessment of their customs practices and ensure adherence to regulatory requirements.Our Customs Health Checkup services encompass:

- Comprehensive Compliance Assessment:

Our team of experienced customs advisors conducts a thorough review of your customs practices, procedures, and documentation to assess compliance with applicable regulations. We analyze various aspects, including tariff classification, valuation, origin determination, duty exemptions, and documentation requirements, to identify potential areas of non-compliance. - Risk Identification and Mitigation:

Non-compliance with customs regulations can expose businesses to various risks, including financial penalties, shipment delays, and reputational damage. Our Customs Health Checkup services help identify potential compliance risks and vulnerabilities in your customs processes. We work closely with clients to develop strategies to mitigate risks and strengthen internal controls to prevent future compliance issues. - Recommendations and Action Plan:

Based on our assessment findings, we provide detailed recommendations and an action plan to address any compliance deficiencies or operational inefficiencies identified during the Customs Health Checkup. We work collaboratively with clients to implement corrective measures and improve customs practices, ensuring ongoing compliance and operational excellence.