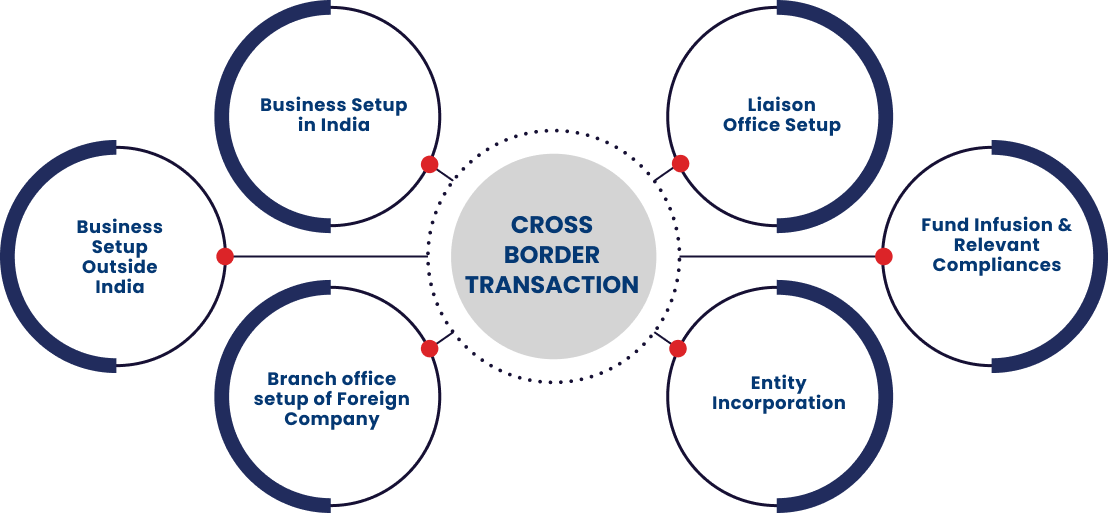

Cross Border Transaction

In today’s globalized business environment, cross-border transactions play a crucial role in facilitating international trade, investment, and financial activities. However, navigating the complexities of cross-border transactions requires specialized expertise and strategic guidance. At Mistry & Shah LLP, we offer comprehensive Cross-Border Transaction Advisory services designed to assist businesses, corporations, investors, and individuals in managing cross-border transactions effectively and efficiently. Our Cross Broder Transaction services includes:-

Business Setup in India

Our Business Setup in India Advisory Services encompass a wide range of critical areas, including:

- Entity Selection and Structuring: We provide guidance on choosing the right business entity structure in India, such as private limited company, limited liability partnership (LLP), branch office, liaison office, or wholly-owned subsidiary. Our team assesses factors like liability protection, tax implications, regulatory requirements, ownership control, capital structure, and operational flexibility to recommend an optimal entity structure.

- Foreign Investment Advisory: For foreign investors, we provide guidance on foreign direct investment (FDI) regulations, sectoral caps, government approvals, reporting requirements, repatriation of funds, and compliance with Foreign Exchange Management Act (FEMA) regulations.

- Taxation and Transfer Pricing: We offer tax planning and advisory services to optimize tax efficiency, manage transfer pricing risks, and comply with Indian tax laws, including corporate tax, withholding tax, indirect taxes, and transfer pricing regulations.

Business Setup Outside India

Expanding business operations outside India requires careful planning, compliance with international regulations, and strategic decision-making. We offer comprehensive Business Setup Outside India advisory services designed to assist businesses, entrepreneurs, investors, and multinational corporations in establishing and expanding their presence in global markets seamlessly and effectively.

Our Business Setup Outside India Advisory Services encompass a wide range of critical areas, including:

- Market Research and Feasibility Studies:

We conduct market research, feasibility studies, and risk assessments to identify viable international markets, industry trends, competitive landscapes, consumer preferences, and regulatory environments. Our team analyzes market entry barriers, cultural factors, economic conditions, and legal frameworks to assess the feasibility of business expansion outside India. - Entity Selection and Global Structuring:

We provide guidance on choosing the right legal entity structure for international operations, such as subsidiaries, branches, joint ventures, franchises, partnerships, or representative offices. Our experts assess factors like taxation implications, liability protection, regulatory requirements, ownership control, capital structure, and operational flexibility to recommend an optimal global structure. - Incorporation and Registration:

We assist in the incorporation, registration, and establishment of the chosen business entity in foreign jurisdictions, including obtaining necessary permits, licenses, and approvals. Our firm handles the preparation of incorporation documents, drafting of partnership agreements, shareholder agreements, and joint venture agreements, and liaising with local authorities for compliance. - International Tax Planning and Compliance:

We offer tax planning and compliance services to optimize tax efficiency, manage cross-border tax risks, and comply with international tax laws, treaties, and transfer pricing regulations. Our team assists in structuring international transactions, managing withholding taxes, filing tax returns, obtaining tax residency certificates, and claiming tax incentives in foreign jurisdictions. - Cross-Border Contracts and Agreements:

We draft, review, and negotiate cross-border contracts, agreements, and legal documents such as distribution agreements, licensing agreements, franchise agreements, and international supply contracts. Our advisors ensure contractual clarity, risk allocation, dispute resolution mechanisms, intellectual property protection, and compliance with international trade laws and conventions. - Global Compliance and Regulatory Support:

We provide guidance on regulatory compliance in foreign markets, including labor laws, corporate governance requirements, data privacy regulations, anti-corruption laws, export controls, and industry-specific regulations. Our firm conducts compliance audits, risk assessments, due diligence reviews, and internal control assessments to ensure adherence to global regulatory standards.

By partnering with us, clients gain access to a dedicated team of international business advisors with expertise in global markets, regulatory frameworks, and cross-border transactions. We are committed to delivering high-quality advisory services, proactive solutions, and value-added support that facilitate successful business setup and expansion outside India.

Branch office setup of Foreign Company

Our Branch Office Setup of Foreign Companies Advisory Services encompass a wide range of critical areas, including:

-

Regulatory Compliance and Approval Process:

We guide foreign companies through the regulatory landscape, including compliance with the Foreign Exchange Management Act (FEMA), Reserve Bank of India (RBI) regulations, and Companies Act provisions for setting up a branch office in India. Our team assists in obtaining the necessary approvals, permissions, and registrations from regulatory authorities, such as the RBI and Ministry of Corporate Affairs (MCA). -

Entity Structuring and Legal Formalities:

We advise on the optimal structure for the branch office setup, considering factors such as taxation, liability, operational control, and compliance requirements. Our experts handle the drafting and filing of incorporation documents, branch office registration forms, statutory declarations, and other legal formalities required for establishing a branch office. -

Financial and Taxation Matters:

We assist in fulfilling financial requirements, such as capital infusion, opening a bank account, and complying with RBI reporting norms for foreign investment in India. Our firm provides tax planning and advisory services to ensure compliance with Indian tax laws, including corporate tax, withholding tax, transfer pricing regulations, and goods and services tax (GST) registration. -

Operational Setup and Infrastructure:

We support foreign companies in setting up their operational infrastructure in India, including office space leasing, staffing, obtaining local licenses and permits, and establishing communication and IT systems. Our advisors liaise with service providers, vendors, and government agencies to streamline the setup process and ensure operational readiness. -

Compliance Monitoring and Reporting:

We help foreign companies navigate ongoing compliance requirements, such as filing annual returns, maintaining statutory records, conducting audits, and adhering to RBI guidelines for branch office operations. Our firm conducts periodic compliance reviews, internal audits, and risk assessments to ensure adherence to regulatory standards and mitigate compliance risks. -

Business Advisory and Expansion Support:

We provide ongoing business advisory services to foreign branch offices, including market insights, regulatory updates, strategic planning, and expansion strategies.

Liaison Office Setup

Our Liaison Office Setup Advisory Services encompass a wide range of critical areas, including:

-

Regulatory Compliance and Approval Process:

We guide foreign companies through the regulatory requirements governing liaison offices in India, including compliance with the Foreign Exchange Management Act (FEMA), Reserve Bank of India (RBI) regulations, and other applicable laws. Our team assists in obtaining the necessary approvals, permissions, and registrations from regulatory authorities, such as the RBI and Ministry of Corporate Affairs (MCA), for establishing a liaison office. -

Entity Structuring and Legal Formalities:

We advise on the optimal structure for the liaison office setup, considering factors such as permissible activities, taxation, operational control, and compliance requirements. Our experts handle the drafting and filing of incorporation documents, liaison office registration forms, statutory declarations, and other legal formalities required for establishing a liaison office. -

Financial and Taxation Matters:

We assist in fulfilling financial requirements, such as capital infusion, opening a bank account, and complying with RBI reporting norms for liaison offices in India. Our firm provides tax planning and advisory services to ensure compliance with Indian tax laws, including withholding tax, transfer pricing regulations, and goods and services tax (GST) registration, applicable to liaison office operations. -

Operational Setup and Infrastructure:

We support foreign companies in setting up their operational infrastructure for the liaison office in India, including office space leasing, staffing, obtaining local licenses and permits, and establishing communication and IT systems. Our advisors liaise with service providers, vendors, and government agencies to streamline the setup process and ensure operational readiness of the liaison office. -

Compliance Monitoring and Reporting:

We help liaison offices navigate ongoing compliance requirements, such as filing periodic reports, maintaining statutory records, conducting internal audits, and adhering to RBI guidelines for liaison office operations. Our firm conducts compliance reviews, risk assessments, and internal control assessments to ensure adherence to regulatory standards and mitigate compliance risks. -

Business Development and Networking:

We provide strategic support to liaison offices in India, including business development insights, networking opportunities, partnership facilitation, and market intelligence. Our team assists in building relationships with Indian counterparts, fostering collaborations, and leveraging industry connections to support the liaison office’s objectives. By partnering with us, foreign companies gain access to a dedicated team of international business advisors with expertise in liaison office setup, regulatory compliance, taxation, and operational support. We are committed to delivering high-quality advisory services, proactive solutions, and value-added support that facilitate successful liaison office establishment and operations in India.

Fund Infusion & Relevant Compliances

Our Fund Infusion and Relevant Compliances Advisory Services encompass a wide range of critical areas, including:

-

Fund Infusion Strategies:

We provide strategic advice on fund infusion strategies, including equity funding, debt funding, venture capital investments, private equity investments, mergers and acquisitions (M&A), and strategic partnerships. Our team assesses business objectives, financial needs, capital structure considerations, risk profiles, and market dynamics to recommend optimal fund infusion approaches. -

Fundraising Documentation:

We assist in preparing fundraising documents, such as investment proposals, private placement memorandums (PPMs), term sheets, subscription agreements, shareholders’ agreements, and loan agreements. Our experts ensure compliance with regulatory disclosure requirements, investor protection measures, contractual obligations, and legal due diligence for fund infusion transactions. -

Regulatory Compliance:

We help businesses comply with regulatory requirements related to fund infusion, including Securities and Exchange Board of India (SEBI) regulations, Companies Act provisions, Foreign Exchange Management Act (FEMA) guidelines, and taxation laws. Our firm assists in obtaining necessary approvals, filings, registrations, and clearances from regulatory authorities, such as SEBI, RBI, Ministry of Corporate Affairs (MCA), and tax authorities. -

Investor Relations:

We support businesses in managing investor relations, communication, and reporting requirements associated with fund infusion transactions. Our advisors facilitate investor meetings, investor presentations, investor queries, shareholder communications, and transparency initiatives to maintain positive investor relationships. -

Due Diligence and Risk Management:

We conduct financial due diligence, legal due diligence, and risk assessments for fund infusion transactions to identify potential risks, liabilities, and compliance issues. Our team assists in mitigating risks, negotiating risk-sharing arrangements, drafting risk-mitigation clauses, and implementing risk management strategies to safeguard stakeholders’ interests. -

Post-Transaction Compliance:

We ensure post-transaction compliance with fund infusion-related obligations, such as share allotments, share transfer registrations, filing of disclosure documents, reporting to regulatory authorities, and shareholder notifications. Our firm assists in maintaining compliance with ongoing regulatory requirements, governance standards, financial reporting norms, and investor disclosures post-fund infusion.

Entity Incorporation

Our Entity Incorporation Advisory Services encompass a wide range of critical areas, including:

-

Entity Structuring and Selection:

We provide strategic guidance on choosing the right business entity structure based on clients’ objectives, such as private limited company, limited liability partnership (LLP), partnership firm, sole proprietorship, or branch office of a foreign company. Our team evaluates factors like liability protection, tax implications, ownership structure, regulatory requirements, and operational flexibility to recommend an optimal entity structure. -

Incorporation Process Management:

We manage the entire incorporation process, from name reservation and obtaining Director Identification Numbers (DINs) to drafting Memorandum and Articles of Association (MOA & AOA), filing incorporation forms, and obtaining the Certificate of Incorporation (COI) or Certificate of Registration (COR). Our experts ensure compliance with the Companies Act, Limited Liability Partnership Act, Foreign Exchange Management Act (FEMA), and other applicable laws and regulations during the incorporation process. -

Regulatory Compliance and Licensing:

We assist in fulfilling post-incorporation compliance requirements, such as obtaining Permanent Account Numbers (PAN), Tax Deduction and Collection Account Numbers (TAN), Goods and Services Tax (GST) registration, and other applicable licenses and permits. Our firm helps clients understand and comply with labor laws, corporate governance requirements, environmental regulations, industry-specific licensing requirements, and other regulatory obligations post-incorporation. -

Shareholding and Capital Structure:

We advise on shareholding patterns, share capital structuring, issuance of shares, share transfer procedures, shareholding agreements, and shareholder rights to ensure clarity and transparency in corporate governance. Our advisors assist in drafting shareholders’ agreements, subscription agreements, share transfer deeds, and other legal documents related to share capital and ownership structure. -

Corporate Secretarial Support:

We provide ongoing corporate secretarial support, including maintaining statutory registers, minutes of meetings, board resolutions, annual filings, and compliance with corporate governance norms. Our team ensures timely submission of required documents, filings with regulatory authorities, conducting board meetings, general meetings, and adherence to corporate compliance calendars. -

Business Advisory and Growth Strategies:

We offer strategic business advisory services to newly incorporated entities, including business planning, financial projections, fundraising strategies, market entry strategies, and expansion plans. Our firm assists in developing business models, identifying growth opportunities, accessing government incentives, and navigating challenges to support clients’ business objectives. By partnering with us, clients gain access to a dedicated team of incorporation specialists, legal advisors, and corporate secretarial experts with deep knowledge of entity incorporation processes, regulatory frameworks, and industry best practices. We are committed to delivering high-quality advisory services, proactive solutions, and value-added support that empower clients to establish and grow their businesses successfully.