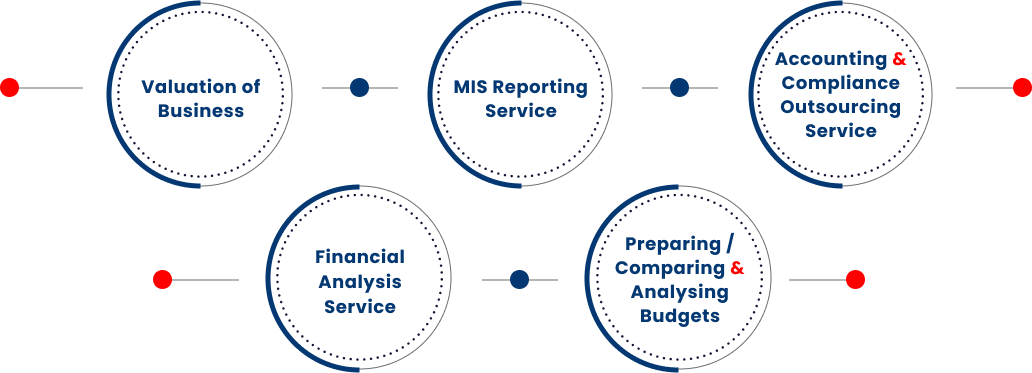

CFO advisory Services

In today’s rapidly evolving business landscape, chief financial officers (CFOs) play a critical role in driving strategic decision-making, optimizing financial performance, and ensuring long-term sustainability. At Mistry & Shah LLP, we offer comprehensive CFO Advisory Services to help organizations harness the full potential of their finance function and achieve their strategic objectives.

Valuation of Business

Understanding the true value of a business is essential for informed decision-making, whether it’s for strategic planning, transactions, financial reporting, or dispute resolution. At Mistry & Shah LLP, we offer comprehensive CFO Advisory on Valuation of Business Services to help organizations accurately assess and maximize the value of their businesses.

Our CFO Advisory on Valuation of Business Service Includes:

Our CFO Advisory on Valuation of Business Service Includes:

-

Business Valuation:

Our expert valuation professionals utilize advanced valuation methodologies and techniques to determine the fair market value of businesses. Whether it’s for mergers and acquisitions, shareholder transactions, financial reporting, or tax planning purposes, we provide reliable and defensible business valuations tailored to our clients’ specific needs. -

Financial Modeling/Restructuring:

We develop sophisticated financial models to analyze and forecast the financial performance and value drivers of businesses. Our modeling experts leverage industry benchmarks, market data, and scenario analysis to provide insightful projections and sensitivity analysis, empowering CFOs and senior management to make informed decisions. -

Transaction Advisory:

We provide transaction advisory services to CFOs and business owners seeking to buy, sell, or invest in businesses. Our transaction advisors offer strategic guidance throughout the deal lifecycle, from deal sourcing and due diligence to negotiation and structuring, ensuring successful outcomes and value creation for our clients. -

Transaction Viability Opinions:

We offer Transaction Viability opinions to evaluate the fairness and reasonableness of financial transactions, such as mergers, acquisitions, divestitures, and corporate restructurings. Our valuation experts conduct rigorous analyses and assessments to provide independent and objective opinions that support our clients’ decision-making process. -

Dispute Resolution Support:

In the event of disputes involving business valuation matters, our team provides expert support and testimony to help resolve disputes effectively. We offer litigation support, expert witness services, and dispute resolution assistance to assist clients in achieving favorable outcomes and minimizing legal risks.

MIS Reporting Service

Accurate and timely management information is essential for CFOs to make informed decisions and drive strategic initiatives effectively. At Mistry & Shah LLP, we offer comprehensive CFO Advisory on MIS Reporting Services to help organizations enhance their management reporting capabilities and achieve their financial and operational objectives.

Our CFO Advisory on MIS Reporting Service Includes:

Our CFO Advisory on MIS Reporting Service Includes:

-

MIS Framework Development:

Our expert consultants work closely with CFOs and senior management to develop customized MIS frameworks tailored to the organization’s strategic priorities and reporting requirements. We design comprehensive reporting structures, data visualization tools, and performance dashboards to provide actionable insights and support decision-making. -

Data Analytics and Visualization:

We leverage advanced data analytics tools and techniques to analyze large volumes of financial and operational data and extract meaningful insights. Our data visualization experts create interactive dashboards and reports that enable CFOs to monitor key performance indicators (KPIs), identify trends, and track progress towards strategic goals in real-time. -

Performance Measurement and Analysis:

We assist CFOs in defining performance metrics and benchmarks to evaluate the financial and operational performance of the organization. Our consultants conduct in-depth analysis and variance reporting to identify areas of improvement, optimize resource allocation, and drive performance improvement initiatives across various business functions. -

Budget vs. Actual Analysis:

We help CFOs compare actual financial results against budgeted targets and forecasts to assess performance and identify variances. Our analysts conduct detailed variance analysis, identify root causes of deviations, and recommend corrective actions to align actual performance with budgeted expectations and strategic objectives. -

Forecasting and Scenario Planning:

We support CFOs in developing accurate financial forecasts and scenario planning models to anticipate future trends and uncertainties. Our consultants utilize historical data, market insights, and predictive analytics to generate forecasts and scenario analyses that enable CFOs to assess potential outcomes and make informed decisions.

Accounting & Compliance Outsourcing Service:

Managing accounting and compliance functions efficiently is crucial for businesses to maintain financial health, regulatory compliance, and operational excellence. At Mistry & Shah LLP, we offer comprehensive Accounting and Compliance Outsourcing Services to help organizations streamline their financial operations, enhance compliance, and focus on their core business activities.

Our Accounting and Compliance Outsourcing Service Includes:

Our Accounting and Compliance Outsourcing Service Includes:

-

Bookkeeping and Accounting Services:

We provide end-to-end bookkeeping and accounting services, including data entry, journal entries, bank reconciliations, accounts payable and receivable management, and financial statement preparation. Our experienced accountants ensure accuracy, reliability, and timeliness in financial reporting, enabling clients to make informed decisions and meet regulatory requirements. -

Financial Reporting and Analysis:

We assist clients in preparing periodic financial reports, including income statements, balance sheets, and cash flow statements. Our financial analysts conduct in-depth analysis and interpretation of financial data to provide valuable insights into business performance, trends, and opportunities for improvement. -

Tax Compliance and Reporting:

Our tax experts ensure compliance with tax laws and regulations by preparing and filing accurate tax returns, including income tax, GST/VAT, payroll taxes, and other statutory filings. We stay abreast of changing tax laws and provide proactive tax planning advice to minimize liabilities and optimize tax efficiency. -

Regulatory Compliance Assistance:

We help clients comply with regulatory requirements and reporting obligations imposed by government agencies and regulatory bodies. Our compliance specialists monitor regulatory changes, maintain compliance calendars, and ensure timely submission of statutory filings, such as annual returns, corporate filings, and regulatory disclosures. -

Payroll Processing and Management:

We offer comprehensive payroll processing and management services to handle payroll calculations, deductions, tax withholdings, and employee benefits administration. Our payroll experts ensure accuracy and compliance with labor laws, minimizing payroll errors and mitigating compliance risks.

Financial Analysis Service

In today’s dynamic business environment, insightful financial analysis is essential for making informed decisions, identifying opportunities, and mitigating risks. At Mistry & Shah LLP, we offer comprehensive Financial Analysis Services to help organizations gain valuable insights into their financial performance, optimize resource allocation, and drive strategic growth.

Our Financial Analysis Service Includes:

Our Financial Analysis Service Includes:

-

Financial Statement Analysis:

We conduct in-depth analysis of financial statements, including income statements, balance sheets, and cash flow statements, to assess the financial health and performance of businesses. Our analysts identify key performance indicators (KPIs), trends, and areas for improvement, providing actionable insights to stakeholders. -

Ratio Analysis:

We perform ratio analysis to evaluate various financial ratios and metrics, such as liquidity ratios, profitability ratios, leverage ratios, and efficiency ratios. Our analysts interpret ratio trends, benchmark against industry peers, and assess the financial strength and stability of organizations, enabling informed decision-making. -

Trend Analysis:

We analyze historical financial data to identify trends and patterns in revenue, expenses, profitability, and other key financial metrics. Our trend analysis helps stakeholders understand past performance, predict future trends, and formulate strategies to capitalize on emerging opportunities and mitigate risks. -

Budget Variance Analysis:

We compare actual financial results against budgeted targets and forecasts to assess performance and identify variances. Our analysts conduct detailed variance analysis, investigate root causes of deviations, and recommend corrective actions to align actual performance with budgeted expectations and strategic objectives. -

Scenario Modeling and Sensitivity Analysis:

We develop financial models to simulate different scenarios and assess the impact of various factors on financial performance and outcomes. Our analysts conduct sensitivity analysis to evaluate the sensitivity of key assumptions and variables, enabling stakeholders to make informed decisions under different market conditions.

Preparing / Comparing & Analysing Budgets

Budgeting is a critical aspect of financial management, providing organizations with a roadmap for allocating resources, setting financial targets, and monitoring performance. At Mistry & Shah LLP, we offer comprehensive services for preparing, comparing, and analyzing budgets to help organizations achieve their financial objectives and make informed decisions.

Our Budgeting Services Include:

Our Budgeting Services Include:

-

Budget Preparation:

We assist organizations in preparing comprehensive budgets tailored to their strategic goals and operational plans. Our experienced professionals work closely with management to develop detailed budget forecasts for revenues, expenses, capital expenditures, and cash flows, ensuring alignment with organizational objectives. -

Budget Comparison:

We compare actual financial results against budgeted targets to assess performance and identify variances. Our analysts conduct detailed budget variance analysis to understand the reasons behind discrepancies and recommend corrective actions to align actual performance with budgeted expectations. -

Variance Analysis:

We perform variance analysis to evaluate differences between actual financial results and budgeted targets. Our analysts analyze variances in revenues, expenses, and key performance indicators (KPIs) to identify trends, outliers, and areas for improvement, enabling organizations to optimize resource allocation and improve financial performance. -

Scenario Analysis:

We conduct scenario analysis to assess the impact of different scenarios on budget forecasts and financial outcomes. Our analysts develop financial models to simulate various scenarios, such as changes in market conditions, pricing strategies, or cost structures, helping organizations anticipate potential risks and opportunities. -

Benchmarking:

We benchmark organizations’ budget performance against industry peers and best practices to identify areas of strength and weakness. Our analysts compare key financial metrics, such as profitability, liquidity, and efficiency ratios, to industry benchmarks and help organizations set realistic targets for improvement.